The post Campbell Korff on why it pays to have your glass half full.. appeared first on .

]]>It’s a well known face that we fear loss two to three times more than we enjoy gains. This psychology explains a lot of our behaviour in everyday life. Indeed, it has been critical to our survival for thousands of years.

Risk aversion can be very important when hunting for food in foreign environments, constructing a dwelling and caring for our young. However, when it comes to investing in the modern world it can lead to chronic underperformance. Here are a few reasons why:

Procrastination – fear of loss causes us to put off financial decisions in the hope tomorrow will be a better day. The problem for pessimists is that day may never come or be so delayed that more damage is done by leaving their capital on the sidelines.

Financial media – if we all felt great about the economy and our financial security we would never pick up a financial newspaper or watch the finance news each night. Our inherent financial insecurity has created a multi-billion dollar industry expert at exaggerating the most obscure financial data so long as it feeds our inherent belief that the financial world might just end tomorrow and send us all bankrupt.

Ignoring the facts – it is a fact that the Australian stock market has delivered average returns in the high single digits for over a century. It is also a fact that over this period only around 1 in 5 years produced negative returns. If you invested $10,000 in the Australian Stock Market in 1980 and re-invested the dividends, these facts would deliver you an investment worth around $850,000 today. You don’t believe me, do you? Our fear of loss causes us to discount positive data even when we know it’s true.

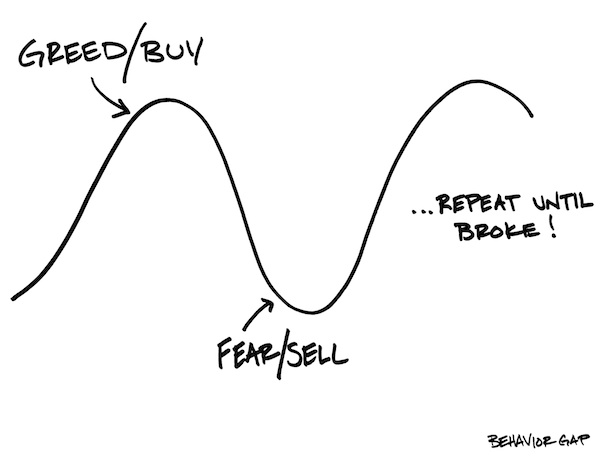

Short term thinking – we invest our savings across our entire adult lives. For most of us, this is a 60 to 70 year timeframe. Yet how often do we make decisions based on short term data? The Australian stock market is down around 15% since April, which is not good news if you need to sell your entire share portfolio tomorrow. If you don’t, history indicates it is more probably a time to think about investing more.

Compounding losses – there’s only one thing worse than losing money; that’s throwing good money after bad! Even when we know we have made a bad financial decision, we often stick our head in the sand in the hope the losses will miraculously disappear, rather than exit and stop the bleeding. Everyone makes mistakes. Face them, learn from them and move on.

Our fear of loss is instinctive, which makes it very hard to displace. However, to be successful investors we must be aware of how it can cloud our judgment and filter out information which is designed to accentuate this fear, rather than help us make good investment decisions.

If you would like to contact Campbell Korff of Yellow Brick Road Ballina go to: www.ybr.com.au/Branches/Ballina

The post Campbell Korff on why it pays to have your glass half full.. appeared first on .

]]>The post Cash vs Shares – the end of the debate appeared first on .

]]>

As a financial adviser Campbell Korff knows what worries people – they don’t want to risk losing their savings, but he also knows that cash simply doesn’t work as a long term investment. He explains why…

The team at Yellow Brick Road Ballina fields around half a dozen enquires a day from people, predominantly retirees, asking what our best term deposit rate is. Upon further enquiry, it is more often than not revealed that the person enquiring has the bulk of their super and savings in cash because: “I lost a lot in the GFC and want to avoid risk”.

This concerns me so much that I recently invited some leading investment experts to Ballina and Byron Bay to deliver a seminar de-bunking some of the commonly understood concepts of risk and investment. The response was so positive, that I thought I would attempt to summarise the key points in this column.

As a case study, we looked at the relative performance of a $10,000 term deposit invested from 1980 to 2013, compared to the same amount invested for the same period in the entire ASX 200 companies (the good, the bad and the insolvent, across a period which included several crashes and crises).

The key conclusions of our discussion were:

- All of us, including most retirees, are investing our super for 20 years plus: matching your investment strategy to your timeframe is critical;

- Inflation is the enemy of long term investors;

- Because of inflation, cash simply doesn’t work as a long term investment;

- A well-diversified portfolio of shares should be part of all long term investment strategies;

- Re-balance your portfolio regularly to manage risk; and

- Don’t try to time the market: invest a little often and don’t overreact to short term volatility.

If you would like more information on these issues, drop me an email at [email protected].

The post Cash vs Shares – the end of the debate appeared first on .

]]>