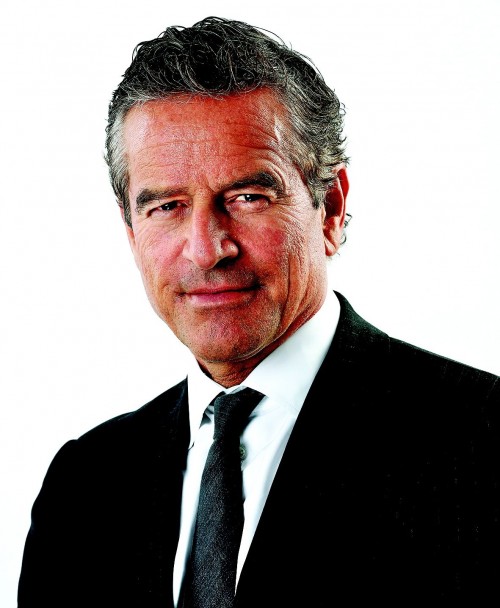

Living with your head in the sand is not a good idea when it comes to your finances, writes Mark Bouris from Yellow Brick Road management of those he calls ‘The Avoiders’…

Living with your head in the sand is not a good idea when it comes to your finances, writes Mark Bouris from Yellow Brick Road management of those he calls ‘The Avoiders’…

I’m often asked to talk about financial affairs but I’m never asked about the people who avoid their financial future. They’re called The Avoiders. What do we know about them?

- they are approximately a quarter of the population

- 65 per cent of Avoiders are women

- only 7 per cent of Avoiders have an adviser

- they are stressed, anxious and overwhelmed about their finances

- they lack confidence to approach an adviser

- they procrastinate and feel out of control

These people are a big concern not only because of the number of them and their pending vulnerability in retirement, but because their predicament is sustained by their own inaction.

Could we be doing better? Can such a large and predominantly female cohort simply be ignored?

There’s always someone who wants the government to step-in, however the government has already done a lot for retirement savers: your employer has to contribute to your super fund, and there are tax concessions in super to allow your contributions to grow.

Governments can only do so much: Australians have to engage with their own financial futures.

If the description of Avoider fits you, and you’re feeling overwhelmed and stressed about finances, I have a simple message for you: ‘You can take control’. Start with a simple budgeting tool – it helps you understand where you are now. From here you can set goals and make decisions.

Most Avoiders could also benefit from financial advice, for information, direction and structure. Yet one of the elements of the Avoiders is their reluctance to call a financial adviser.

Let’s look at the key myths that stop them from seeing a financial planner.

- “It’s too hard”. No it’s not. Financial planners clarify complex issues, and they can even be accessed through your super fund. Financial advisers specialise in repairing problems and planning for the future.

- “It takes too much time”. It takes a few hours each year. Once you’ve set a plan, the adviser does most of the administrative work.

- “I’ll get to it later”. If you’re procrastinating, you’re avoiding making decisions. The earlier you get started, the better your financial results.

- “I don’t have enough to work with.” Actually, the less you have, the more important it is to get assistance. Financial planning can significantly add value and most financial planning results exceed the costs of it.

- “They won’t be interested in me”. Everyday Australians are the ones who need a financial adviser. Financial advice can propel the average middle class Australian to the next level, with advice on debt management, savings, investments and retirement planning. An adviser can be someone you go to with questions.

One of the things we know about financial security is that the earlier you start and the greater your understanding, the better your outcomes. If you’re an Avoider, chances are you simply don’t want to take the first step. My advice: take a deep breath, pick up the phone and talk to an expert. Taking the first step could change your life.